The Problem

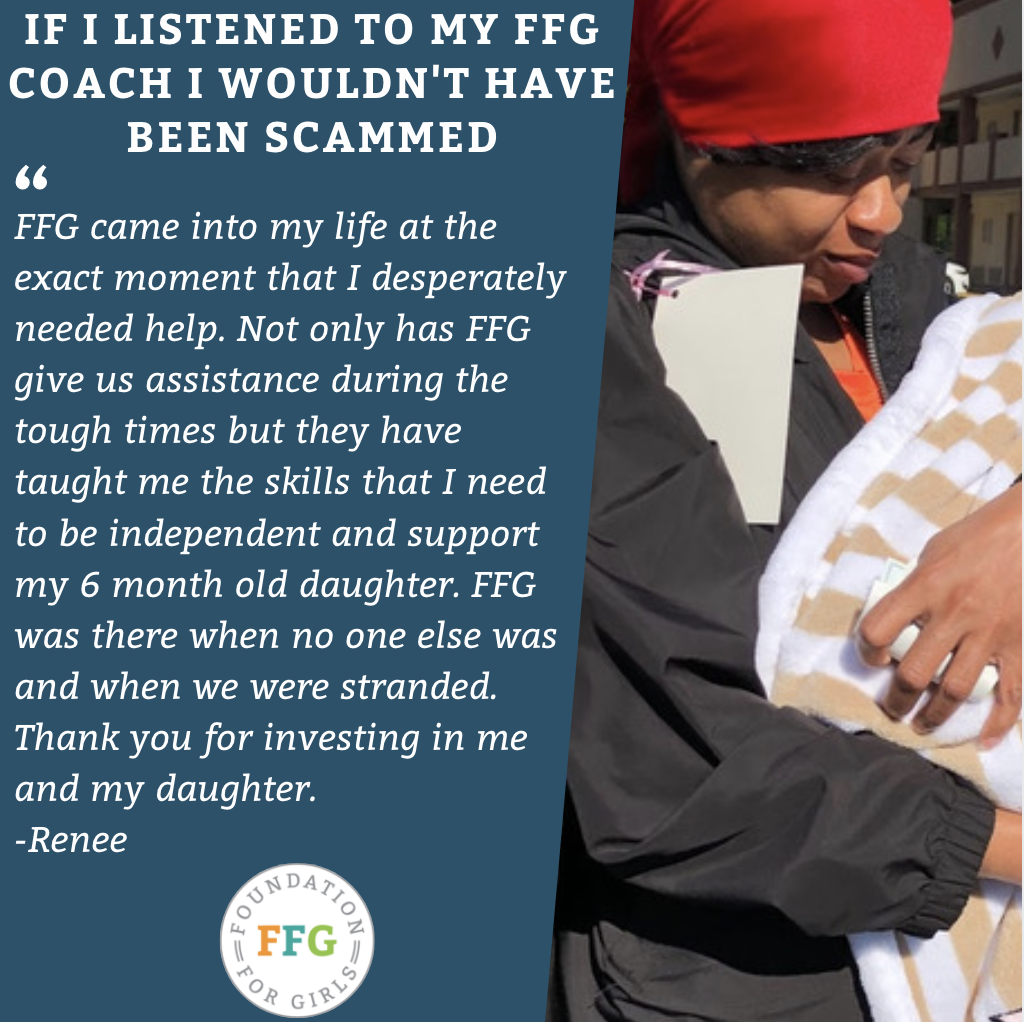

Girls in the foster care system and those aging out lack confidence in themselves because of a lack of consistent community support, low financial resilience, and inability to independently support themselves and their children.

Our Evidence-Based & Research-Backed Work

There are no shortcuts to addressing systemic issues. It takes time consistency and collective action over time. It requires multi-stakeholder and multi-generational collaboration to create sustainable multi-generational impact.

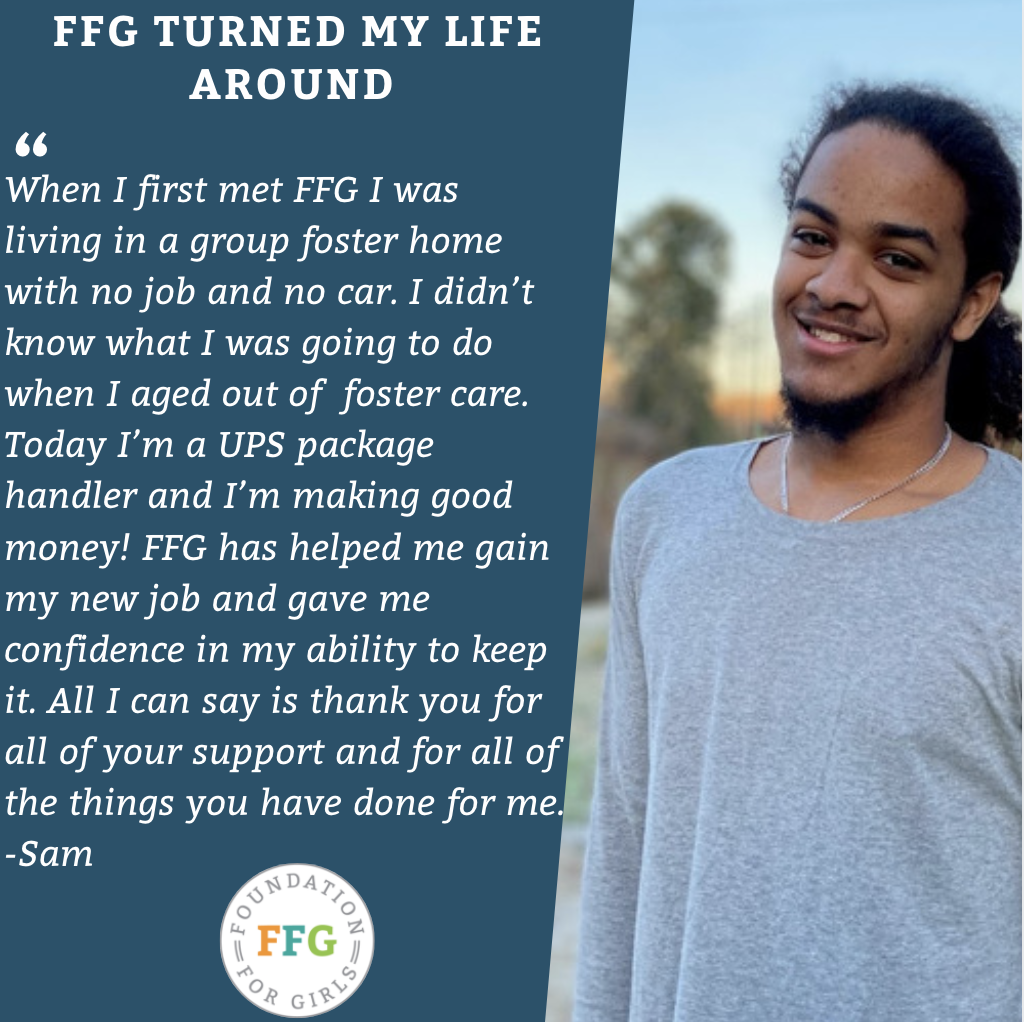

Since our inception in December 2014, we have invested in and touched the lives of over 2,700 women and their children (1500 women and 1200 children). This has resulted in 169 transformational journeys (89 women and 80 children). FFG participants have secured higher-paying jobs, retained current work, gone to college, completed high school, taken care of their children, and are in stable living arrangements. However, this group needs many years of support and investment from a caring community. We begin with investing intellectual capital, supporting through emotional capital, and then extending social capital.

Our impact ratio is 1:5—for every woman empowered; we support five others in their network.

Financial Resilience Building and Enabling Economic Mobility for marginalized women takes time, consistent effort, and collective action.

The 50/50 Principle of FFG

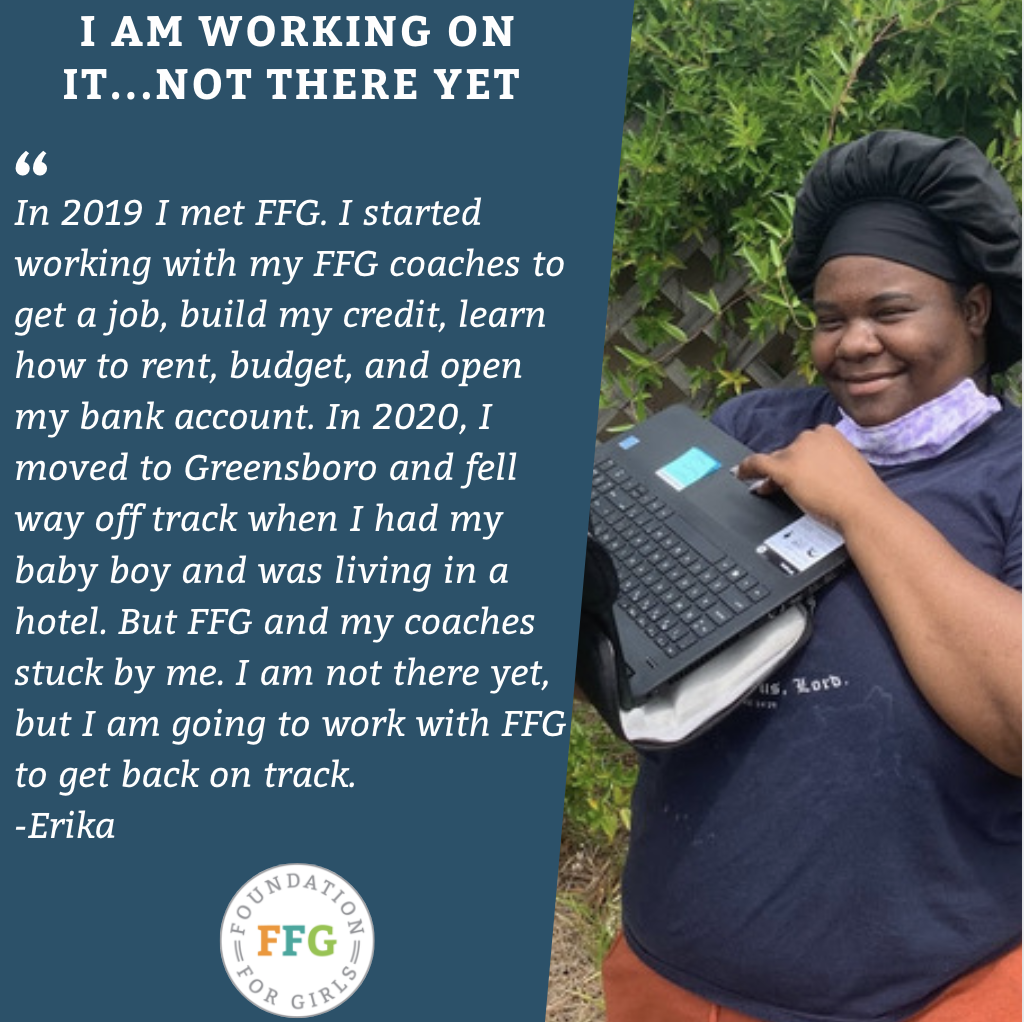

Our work is a partnership between our coaches and marginalized women. We meet the women where they are and invest intellectual, emotional, and social capital to help them become financially resilient and economically independent. But to move them forward, it is a 50/50 partnership. We expect women to invest their time and effort and play an active role in changing their lives.

Multi-Generational and Multi-dimensional Impact For Systemic Change

2014 - 2024: Over the past decade

1500+ women & 1200+ children

169 Transformational Journeys (89 women and 80 Children)

“Over the last ten years, the work of FFG has led to 169 transformational journeys for 89 women and 80 children, where young moms have become financially resilient, have made economic progress, and are prepared to successfully and independently support themselves and their children. These women have moved from a homeless shelter to a rented apartment, have had a steady job for at least three years, have a vehicle, have six months of savings in the bank, have improved their credit scores, and can care for their children.”

- Sahana Mantha, Co-Founder

“

Financial well-being can be defined as a state of being wherein a person can fully meet current and ongoing financial obligations, can feel secure in their financial future, and is able to make choices that allow enjoyment of life.

- CFPB Report on Financial Well-Being

We measure qualitative impact in 5 ways:

1.

Number of positive interactions that build trust and create stable coaching relationships

2.

Improved knowledge, skills, and behaviors to be financially savvy, digitally capable, and career confident

3.

Access to quality, consistent coaches and professionals and Circle of Care support to meet essential needs

4.

Improved mental well-being and long-term community support

5.

Improved attitude to use tiny habits and micro-steps to attain financial, career and Individual goals

We Enable:

Equity

Self-Belief

Self-Reliance

Self-Confidence

We Provide:

Community

Knowledge & Skills

Circle of Care

Opportunities

We Prepare For:

Financial Resilience

Financial Security

Financial Stability

Economic Mobility